39 gift card for employee taxable

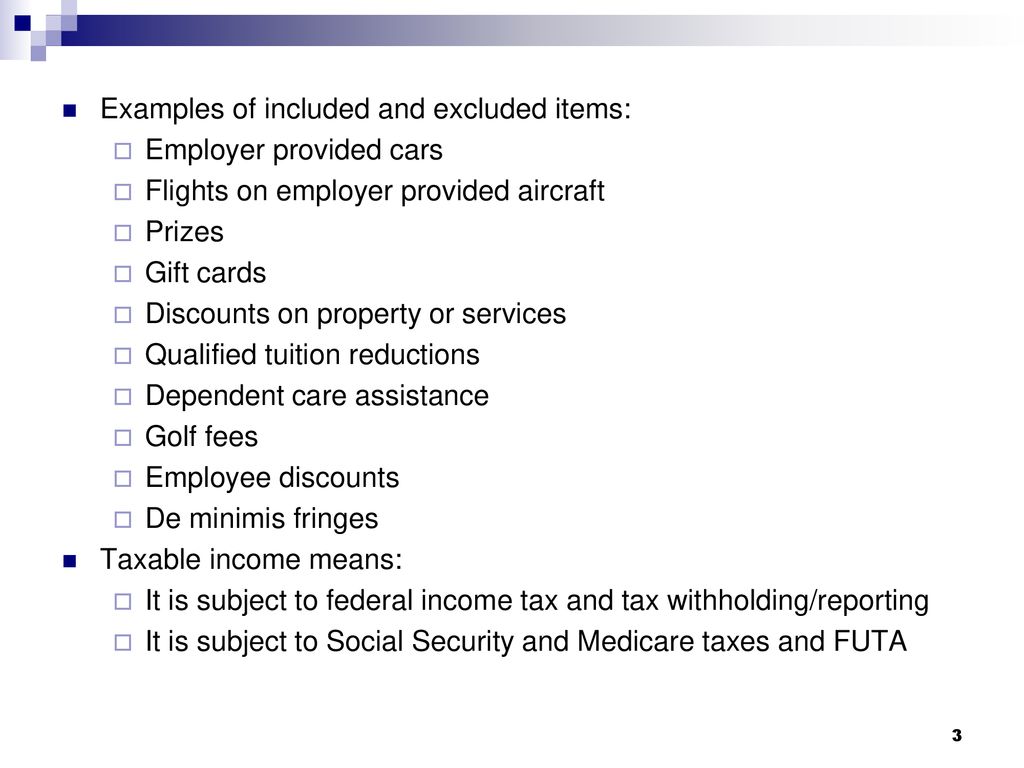

Publication 525 (2021), Taxable and Nontaxable Income The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employee's income through a ... (PPP) loan, effective for taxable years ending after 3/27/2020. (See P.L. 116-136.) Likewise, gross income ... a gift certificate, or a similar item that you can easily exchange for cash, you include the value ... Are Employee Gift Cards Considered Taxable Benefits? According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages.

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages - SHRM Thus, when an employer gives an employee a gift, it is taxable under Section 102(c) unless another exception applies. ... a gift card or gift certificate that can only be redeemed for a specific ...

Gift card for employee taxable

How To Tax Gift Cards In Payroll? - Law info How much tax do you pay on a gift card to an employee? To give your employees a gift card with a value of $100 after taxes, record it as $142.15 gross and withhold $42.15 for taxes. When you give gift cards to employees, include the value in the employee's wages on Form W-2. Are gift cards subject to payroll taxes? Gifts, awards, and long-service awards - Canada.ca Where our policy on non-cash gifts and awards applies, only amounts over the $500 limit must be included in the employee's income. For example, if you provide gifts and awards with a total value of $650, there is a taxable benefit of $150 ($650 - $500). Include items whose FMV may have been altered by a logo or engraving in the calculation. FAQ: Are Gift Cards for Employees a Tax Deduction? - Level 6 Incentives Previously, you could consider gift cards as fringe benefits and write off up to $25 per employee per year. Now, you cannot write off any of that value. Per SHRM: "In the past, employers could give employees cash or a cash equivalent gift such as a gift certificate for amounts less than $25 without any tax concern.

Gift card for employee taxable. Gifts to Employees - Taxable Income or Nontaxable Gift? The tax-free value is limited to $1,600 for all awards to one employee in a year. Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Gifts to Customers Many companies also give gifts to highly valued customers during this time of year. De Minimis Fringe Benefits | Internal Revenue Service - IRS tax forms Cash or cash equivalent items provided by the employer are never excludable from income. An exception applies for occasional meal money or transportation fare to allow an employee to work beyond normal hours. Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. Are gift cards provided to employees, non-employees or students taxable? Jul 1, 2022 Knowledge Employees: All Gift Cards, regardless of value, are considered cash or a cash equivalent gift or award and will be reported as taxable compensation to the employee, subject to appropriate federal, state and employment tax withholding, and must be included in the employee's year end Form W-2, Wage and Tax Statement. Are Gift Cards taxable For Employees - Blackhawk On Demand While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. • Employee protection and performance rewards of real property, such as a watch, can be deducted up to $400 per year per worker.

Small Business Gift Cards Guide & 10 Best POS Gift Card Systems 10.5.2022 · Whatever gift card program you use with Stripe may charge its own fees, however. Hardware Cost. N/A. Payment Processing. Stripe’s online payment processing has a flat rate of 2.9% + $0.30. The gift card software you use with Stripe may or may not charge an additional transaction fee on gift card purchases. Contract Requirements/Warnings Fidelity Investments - Retirement Plans, Investing, Brokerage, … Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of investment products including Mutual Funds, ETFs, Fixed income Bonds and CDs and much more. The Points Guy - Maximize your travel. How we estimate There isn’t a strict mathematical formula at work here. At some point we’d like to create a system that could calculate a precise value based on award availability, fees, award levels and ease of accrual, but for now these valuations are based on a combination of how much TPG would pay to buy points if given the opportunity, and the overall value I could get from redeeming ... Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

Ask the Expert: Are All Gift Cards Taxable Income? - HR Daily Advisor However, section (c) (1) of this law provides that employee gifts (including prizes and awards) - specifically "any amount transferred by or for an employer to, or for the benefit of, an employee" - may not be excluded from gross income. So the general rule is that employee gifts and prizes are counted as income. Can I give my employee a gift card without being taxed? There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount. No matter the amount, a gift card given to employees is not considered a de minimis fringe benefit. Stratus.hr - Elevated HR for Elite Employers. Utah PEO Stratus.hr - Elevated HR for Elite Employers. Utah PEO Are Gift Cards Taxable to Employees? - Eide Bailly According to the IRS's gift card tax rules, since cash and cash-equivalent fringe benefits like gift certificates have a readily-ascertainable value, they do not constitute de minimis fringe benefits. This means that businesses must report gift cards as part of an employee's wages on the Form W-2.

Are Small Gifts To Employees Taxable? - LegalProX The employee has to report the value of the gifts on their Form W-2. Gifts from one person to another aren't taxed. Under the gift tax exclusion, gifts of up to $14,000 per person are not subject to gift tax. See also Which Type Of Violation Is One That The Employer Intentionally And Knowingly Commits?

What Employee Gifts Are Taxable? - Gift Me Your Time The annual exclusion is $15,000 for each of the next three years. The annual exclusion will be $16,000 in 2022. Is a $25 gift card taxable income? Unless specifically excluded by a section of the Internal Revenue Code, cash gifts, including gift cards, are considered to be taxable wages by the IRS. Are small gifts to employees taxable?

Are gift cards taxable income? | Taxation, fringe benefits & more While many infrequent employee gifts are deemed a de minimis fringe benefit and nontaxable, gift cards are considered supplemental income and should be included in an employee's income and thus, is taxable income. As such, the amount of the card is subject to Social Security tax and Medicare tax as well. The rationale behind this makes sense ...

Are Gifts to Employees Taxable? - SST Accountants & Consultants But if the employer gave a gift card to a grocery store for the employee to purchase a turkey, the value of the gift card would be taxable because it is a cash equivalent. For more information, please refer to IRS Publication 5137, Fringe Benefit Guide , or contact the experts at SST for additional assistance.

Publication 15-B (2022), Employer's Tax Guide to Fringe Benefits Cash and cash equivalent fringe benefits (for example, gift certificates, gift cards, and the use of a charge card or credit card), no matter how little, are never excludable as a de minimis benefit. However, meal money and local transportation fare, if provided on an occasional basis and because of overtime work, may be excluded, as discussed later.

Amazon Gift Card Code | Exciting Offers & Discounts | Instant ... The Amazon Gift Card Code can only be redeemed once. What if my Amazon Gift Card Code Expires? It would be better to use your Amazon Gift Card Code before it expires. What are the Available Denominations of PAYBACK Amazon Gift Card Code? The available denominations for PAYBACK Amazon Gift Card Code are as follows: Rs.250; Rs.500; Rs.1000; Rs.5000

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot … 2.8.2022 · Let’s say you wanted to give an employee a $100 gift card for the holidays. You decide to use the percentage method for federal income tax. Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00

Understanding the Taxability of Employee Non-Cash Awards and Gifts The Federal Tax Cuts and Jobs Act (P.L. 115-97) signed into law on December 22, 2017 changed the taxability of some non-cash awards and other gifts provided to employees. If an award or gift (or portion of an award or gift) is taxable, applicable income tax withholding and FICA taxes will be deducted from the employee's paycheck.. Beginning on April 1, 2018, departments are responsible for ...

Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram To save on the tax dollars associated with employee gifts, you can opt to build gift card taxes into employee's salary using this simple formula: Face Value of the Gift Card x Tax Percentage/1-Tax Percentage. 3 Big Benefits of Giftogram Gift Cards for Employees and Customers Manage Gift Card Transactions with Giftogram's Reporting Tools

Tax Rules of Employee Gifts and Company Parties - FindLaw Taxable gifts: Gift certificates (cash in kind) are wages subject to taxes -- even for a de minimis item. For example, a gift certificate for a turkey is taxable, even though the gift of a turkey is not. Cash gifts of any amount are wages subject to all taxes and withholding. Gifts Under $25: Gifts under $25 are typically tax-exempt.

Are Gift Cards Taxable Income? | Sapling Though a gift card may be of seemingly small value, the IRS has stated unequivocally that "cash equivalents" are always considered income. The question, then, is whether a gift card is a cash equivalent. It depends on the type of card. ... Employers are responsible for reporting taxable fringe benefits paid to employees. They will be included ...

Instructions for Form 709 (2022) | Internal Revenue Service If you gave gifts to someone in 2022 totaling more than $16,000 (other than to your spouse), you probably must file Form 709. But see Transfers Not Subject to the Gift Tax and Gifts to Your Spouse, later, for more information on specific gifts that are not taxable.. Certain gifts, called future interests, are not subject to the $16,000 annual exclusion and you must file Form 709 …

Know the tax rules for gifts to employees and customers - Beliveau Law But if you give an employee cash (or a cash equivalent), that's always considered wages, even if the amount is de minimis. So if you give an employee a $10 Starbucks gift card as a thank-you for working late, the $10 is considered taxable. Stock options are also taxable, and can be subject to complex rules.

PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and ... amount the employee paid after taxes for the benefit, less any amount the law excludes. In general, this rule applies to employer-furnished housing. ...

Are Gift Cards Taxable? IRS Rules Explained - marketrealist.com Grossing up means you increase the value of the gift card to account for the taxes that will be taken from it. So, if the gift card is subject to about 30 percent in taxes, you would give...

Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

Taxation in the United States - Wikipedia The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees.In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of …

Are gift cards taxable employee benefits? | PeopleKeep Is there tax on gift cards? Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s.

Frequently Asked Questions on Virtual Currency Transactions In 2014, the IRS issued Notice 2014-21, 2014-16 I.R.B. 938 PDF, explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency. The frequently asked questions (“FAQs”) below expand upon the examples provided in Notice …

FAQ: Are Gift Cards for Employees a Tax Deduction? - Level 6 Incentives Previously, you could consider gift cards as fringe benefits and write off up to $25 per employee per year. Now, you cannot write off any of that value. Per SHRM: "In the past, employers could give employees cash or a cash equivalent gift such as a gift certificate for amounts less than $25 without any tax concern.

Gifts, awards, and long-service awards - Canada.ca Where our policy on non-cash gifts and awards applies, only amounts over the $500 limit must be included in the employee's income. For example, if you provide gifts and awards with a total value of $650, there is a taxable benefit of $150 ($650 - $500). Include items whose FMV may have been altered by a logo or engraving in the calculation.

How To Tax Gift Cards In Payroll? - Law info How much tax do you pay on a gift card to an employee? To give your employees a gift card with a value of $100 after taxes, record it as $142.15 gross and withhold $42.15 for taxes. When you give gift cards to employees, include the value in the employee's wages on Form W-2. Are gift cards subject to payroll taxes?

0 Response to "39 gift card for employee taxable"

Post a Comment